US Tariffs Threaten Markets, Spark Global Economic Concern

Background

Global financial markets reacted cautiously as US stock futures registered declines following a new tariff threat from the United States. The proposed 10% levy on imports from eight European nations, linked to a dispute over Greenland, has ignited fresh concerns about international trade stability and transatlantic relations.

Market Context

The S&P 500 futures fell by 0.9%, while Dow Jones Industrial Average futures saw an 0.8% drop. This immediate market response underscores investor apprehension regarding escalating trade tensions. The targeted European countries — Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland — issued a unified condemnation, warning of potential damage to strategic alliances.

Local Relevance

Stephen Innes of SPI Asset Management noted that these policy moves challenge the foundational trust within Western alliances. He described the situation not as a fleeting market dip, but a "slow rebalancing story," implying more profound, long-term shifts in global capital flows and investment patterns.

Outlook

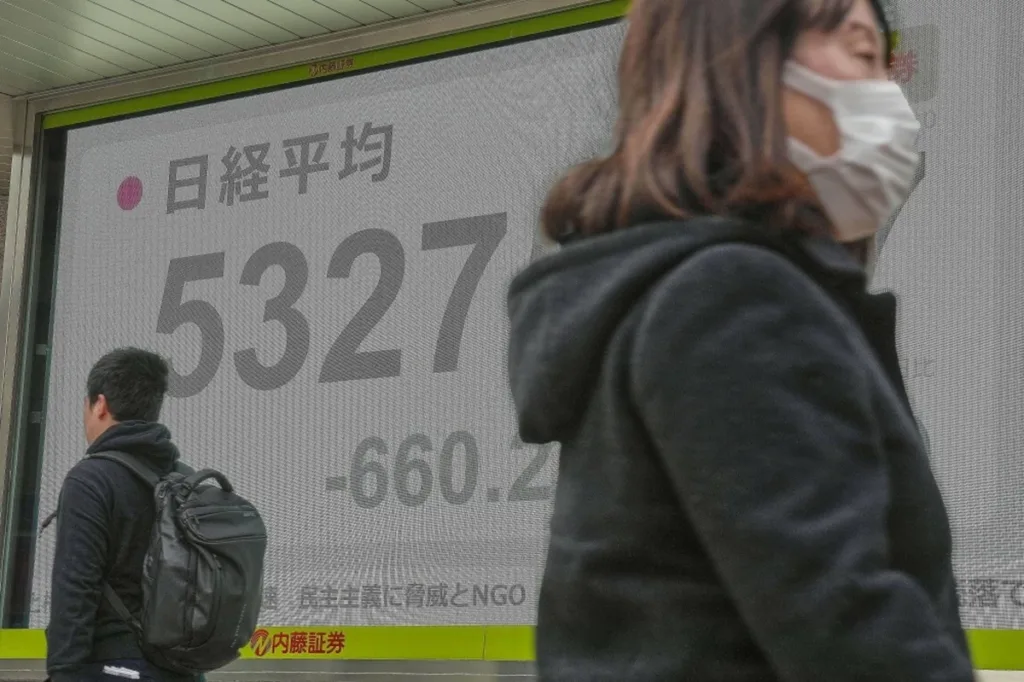

Across Asia, markets presented a mixed picture. Hong Kong's Hang Seng index declined by 1.1%, and Tokyo's Nikkei 225 fell 0.7%. Conversely, the Shanghai Composite index edged up 0.3%, and South Korea's Kospi surged 1.3%, driven by strong performances in technology sectors. Oil prices also saw a modest increase amidst the broader uncertainty.

For Kuwait and GCC investors, such geopolitical developments carry significant weight. The stability of global trade and commodity markets directly impacts regional economies. Increased policy uncertainty often drives demand for safe-haven assets like gold, a key investment area for many in the Gulf. Regional finance houses and investment funds closely monitor these shifts, adjusting portfolios to mitigate risks and capitalize on new opportunities in a volatile global economy.

The latest tariff threats highlight a period of heightened geopolitical risk. As international relations continue to evolve, investors worldwide, including those in the GCC, will be watching closely for further policy announcements and their potential ripple effects on global trade, investment, and market stability.